Can You Capitalize Interior Design Costs

25+ Can You Capitalize Interior Design Costs Purchase price of the item and related taxes.

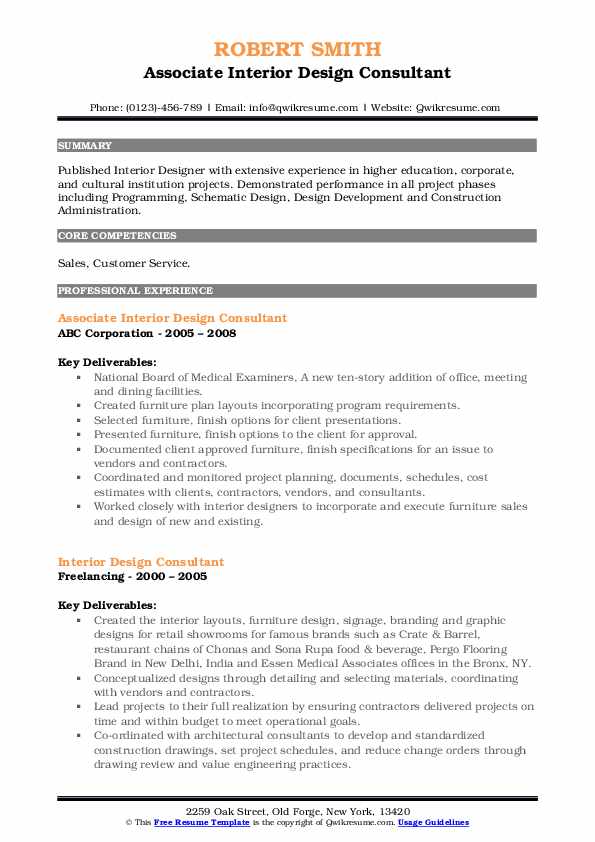

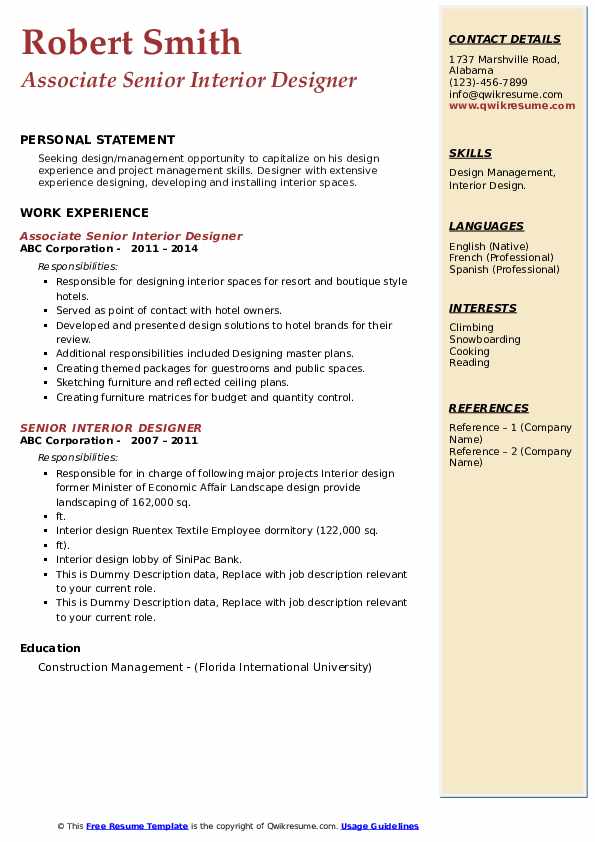

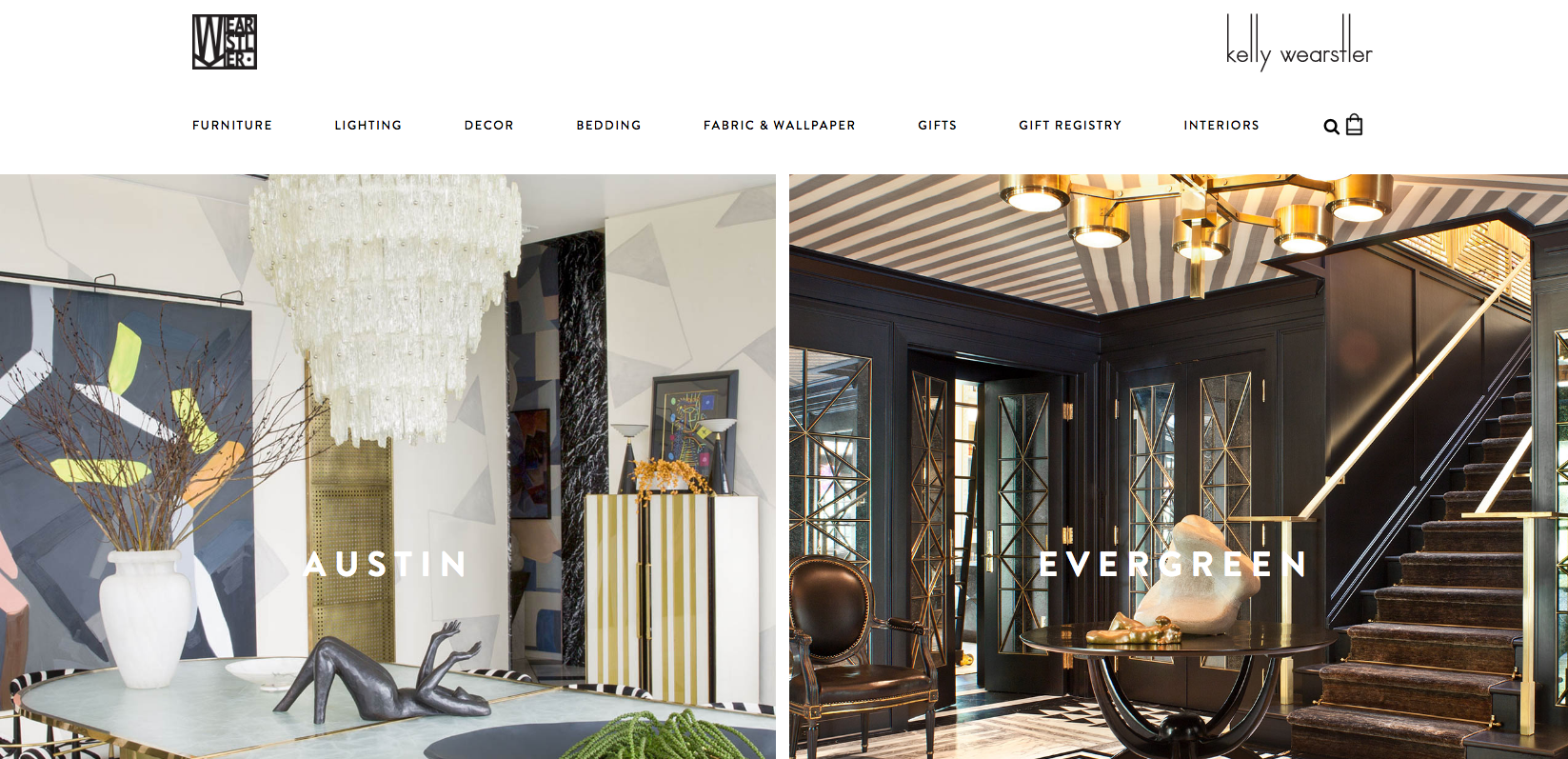

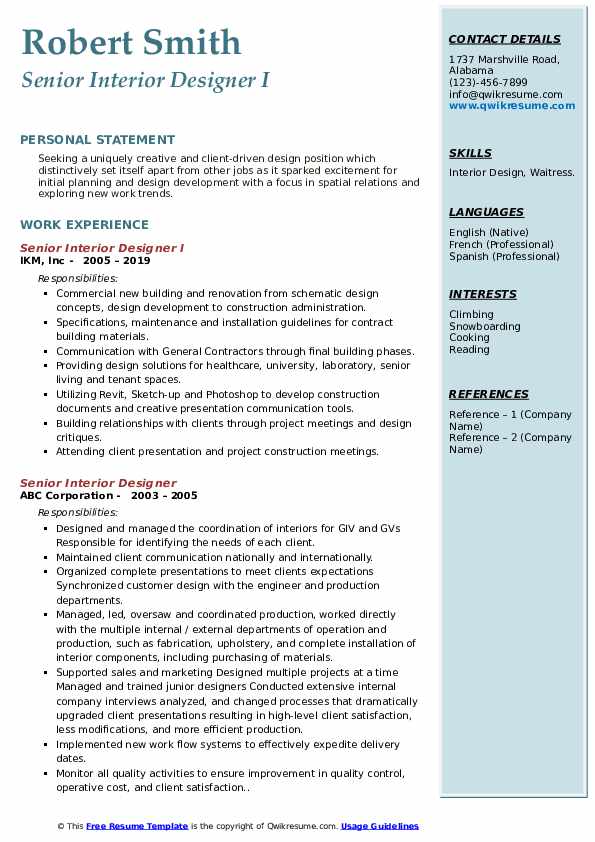

Can you capitalize interior design costs. The designing is not done physically as yet and we will move into the new premises only n a couple of months. If the taxpayer is paying the interior designer to shop for furniture and fixtures and to make recommendations on a new office layout then the costs paid to the interior designer for these services must be capitalized as part of the furniture and fixtures cost. You will treat the costs of creating a website in the same way as computer software if a business looks to a third party to design develop create and program the website. More specifically assign the following costs to a fixed asset. We have paid qr75000 to a vendor for interior design for our showroom.

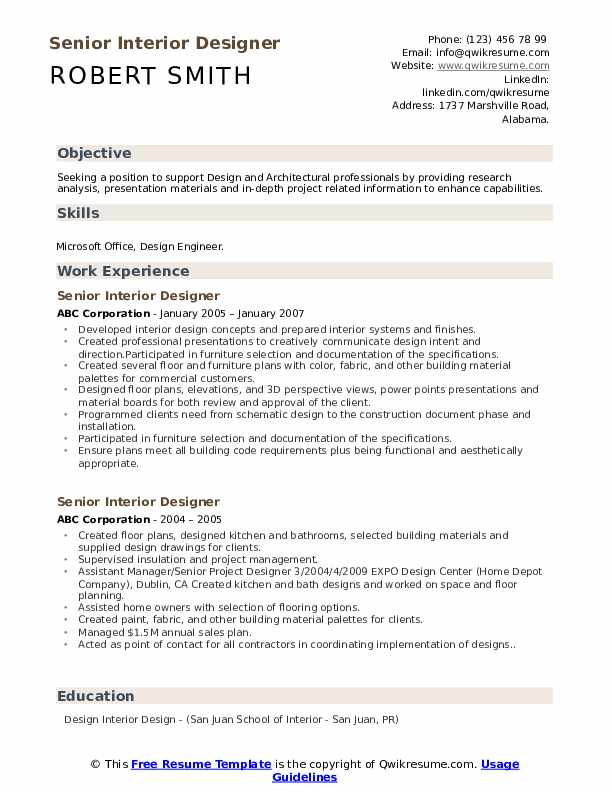

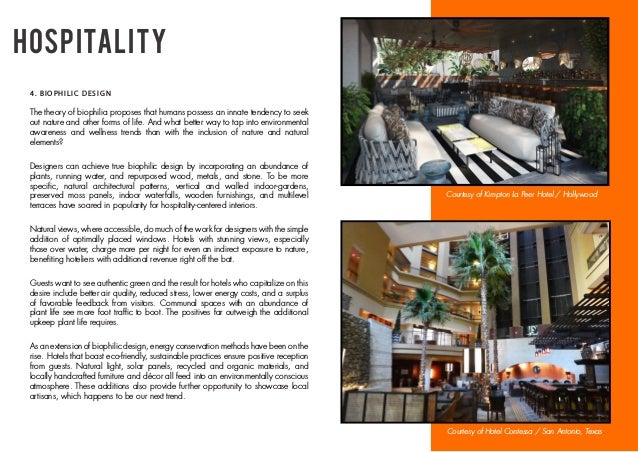

For the remodel design of an existing asset considered to be a part of the improvement of that asset and therefore can be. This is any improvement to an interior part of a building that is nonresidential real. Can architect and engineer fees be capitalized. In this case of rented property the same is not regarded as fixed asset and also the expenditure on interior design does not. The costs to assign to a fixed asset are its purchase cost and any costs incurred to bring the asset to the location and condition needed for it to operate in the manner intended by management.

Just a note of caution with that enalogy in that when it comes to construction of property the architects fees would have to be apportioned in line with the value of the qualifying plant machinery within the factory ie you could not capitalise the. Therefore you should capitalize these costs into the cost of building. Those expenditure which increases the future benefits of an asset from its previously assessed standard of performance can be added to cost of the assetas10. If the amount paid to the interior design was less that the de minimis safe harbor. The qr75000 is a down payment for signing contract plus we have received some drawings.

If the website is created in house the costs may either be deducted in the year the costs are paid or accrued depending on accounting method used or amortized and treated like computer software. Pls clarify whether i need to capitalize the. What costs can be capitalized as leasehold improvements. Capital costs for construction projects designing buildings wiki share your construction industry knowledge. You would need to examine whether they represent the separate asset or not but in general if the building is not operational without these assets then i would include them in the cost of building.

Construction cost of the item which can include labor and employee benefits. If an architect designed your factory which you then had built would you doubt that the architects fees are part of the cost of construction.

/dried-fruit-healthy-nuts-3fa6511bfb5d426db8128bd43db1bd3d.jpg)

/GettyImages-531337715-573236785f9b58723d20adb6.jpg)

:max_bytes(150000):strip_icc()/GettyImages-129284594-ece1aa7f51924c87865ee2ef6ec33fde.jpg)

/GettyImages-1086691530-5c228462fa554bf1826295d112e62059.jpg)

-retouched-Photographer-Rikki-Snyder-Stylist-Frances-Bailey.jpg)